Real estate investment platform

A real estate leveraging investment platform typically refers to a platform that allows individuals or investors to access and invest in real estate opportunities that are traditionally not easily accessible to individual investors. These platforms provide an avenue for investors to pool their funds and invest in real estate projects, such as development or rental properties, through various investment models, such as crowdfunding or syndication.

Some key features and benefits of a real estate leveraging investment platform include:

Diversification: Investors can diversify their real estate investment portfolio by participating in multiple projects across different locations and property types.

Access to larger projects: These platform provide access to institutional-grade real estate projects that may require significant capital investment, which individual investors may not have access to on their own.

Reduced investment risk: By pooling funds with other investors, individuals can share the investment risk associated with the real estate project.

Professional management: These platforms typically have teams of experienced real estate professionals who manage the investment process, from sourcing and due diligence to asset management and revenue distribution.

Transparency and reporting: Investors can access regular updates, financial reports, and performance metrics related to their investments through the platform.

It's important to note that each real estate leveraging investment platform may have its own specific features, investment options, and acceptance criteria for investors. Before participating in such a platform, it is advisable to carefully review the terms and conditions, conduct thorough due diligence, and ensure that the platform aligns with your investment goals and risk appetite.

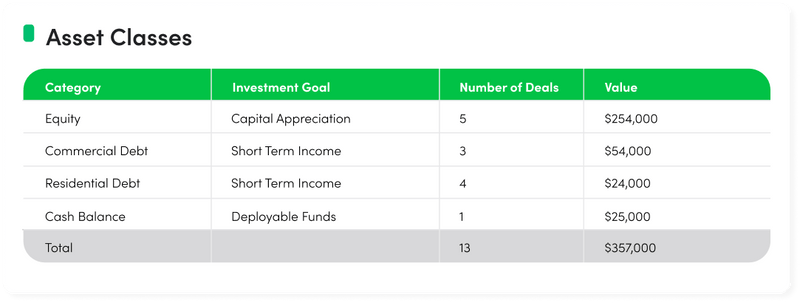

Diversified portfolio of Class A, B and C multifamily properties in high-growth markets. Target assets include 100+ unit multifamily properties with a blend of Core, Core Plus, and Value-Add deals. A diversified fund investing in residential and commercial debt loans along with commercial equity deals focusing on multifamily, senior living, mobile home parks and more.

- 12-14 months for Debt Deals

- 3-5 years for Equity Deals

- Target returns of 7%-12% on debt and 12%-25% on equity

- Earnings are reinvested in deals

- Customizable deal slices to lower minimum

- Financing 85% LTV

For example, how you may benefit from our programs: initial investments 5m usd > profit from trading 50m usd, commercial property valued at 250m usd, 85% LTV is financing for 20-30 years, as a mortgage loan and your investments 15% which is 37,5m usd (down payment). The bank`s loan interest rate 4,5% and IRR 10-15%, total net profit after deduction of bank`s interest is 5.5% - 11% on the leveraged real estate investment = approx. 12.5m up to 25m usd

(or 200-500% for the period of loan contract).

Our management fee is 20%. Additional information upon request.